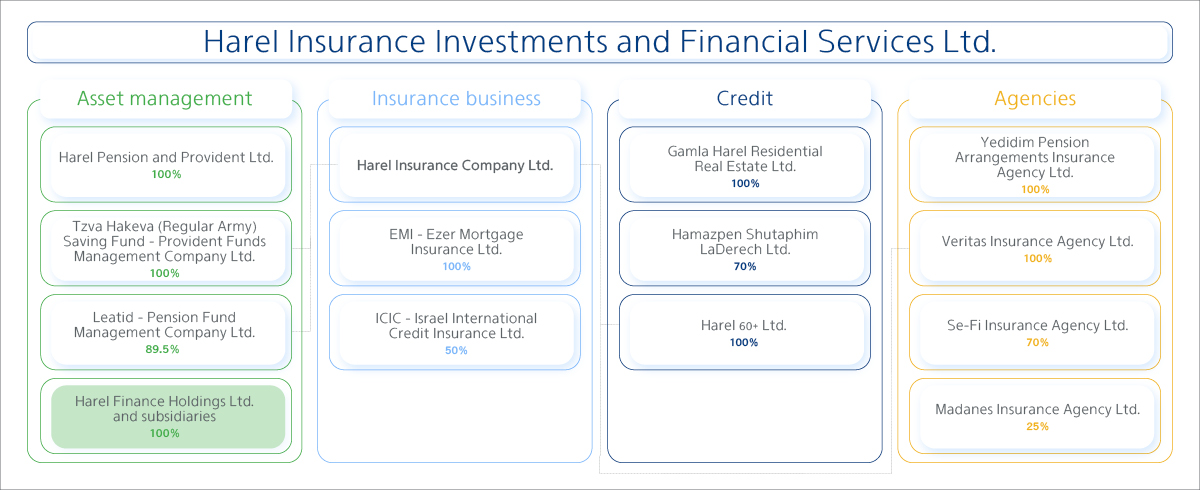

Harel Insurance Investments and Financial Services Ltd. Group is the largest insurance and financial group in Israel, operating in insurance, asset management and credit segments. Main Group's activities are in the following: In insurance, Harel is active in Health, Non-Life and Life Insurance. In addition, the Group is active in credit insurance via ICIC (Israel Credit Insurance Company) and in mortgage insurance via EMI. The Group is also active in insurance overseas, via Turk Nippon in Turkey and via Interasco in Greece. In asset management the Group is active in pension funds, provident funds including education funds, mutual funds, portfolio management, ETFs, and provides various financial services in the capital markets via Harel Finance and its subsidiaries. In credit segment, the Group is active in medium businesses credit via Hamatzpen, in mortgages and reverse mortgages via Harel 60+ , credit to real estate developers and in financial guarantees for third parties related to mortgage portfolios.